Let’s begin with an update on what’s happening on the virus front. From The Associated Press – Coronavirus cases surpass 8 million worldwide, according to Johns Hopkins.

More than 8 million people around the world have been sickened by the novel coronavirus as of June 16, according to the data from the Johns Hopkins Coronavirus Resource Center. The U.S. makes up for 2.1 million of those confirmed cases, and more than 115,000 Americans have died from the virus, leaving the country with the highest number of COVID-19 infections and related deaths.

As the bottom panel of the following chart shows, the rate of new daily worldwide infections is at a new high. This might be a function of more testing, but countries in the southern hemisphere are seeing higher infection rates as their winter begins.

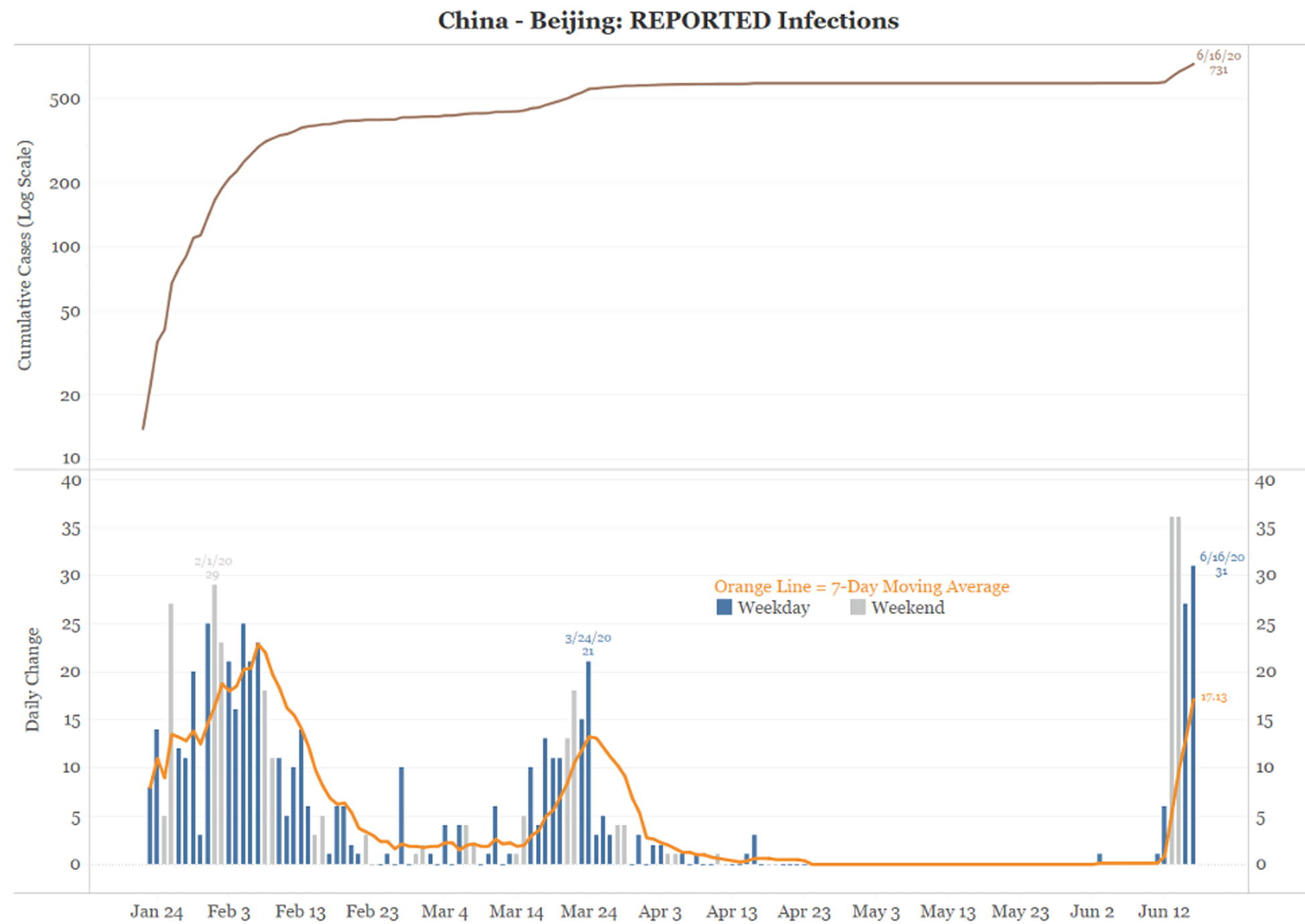

Unfortunately, we are seeing rates of infection increase (that is, the pace of new infections) in Africa, Central and South America, and India. As well, China has now taken measures to restrict travel as Beijing sees an unexpected wave of virus growth:

According to Reuters, more than 60% of commercial flights in and out of Beijing have been canceled as the Chinese capital raised its alert level Wednesday, June 17th, against a new coronavirus outbreak. Other nations are facing rising numbers of illnesses and deaths as well. The virus prevention and control situation in Beijing was described as “extremely grave” at a meeting of Beijing’s Communist Party Standing Committee led by the city’s top official, Party Secretary Cai Qi. Let’s hope that they can get this under control quickly.

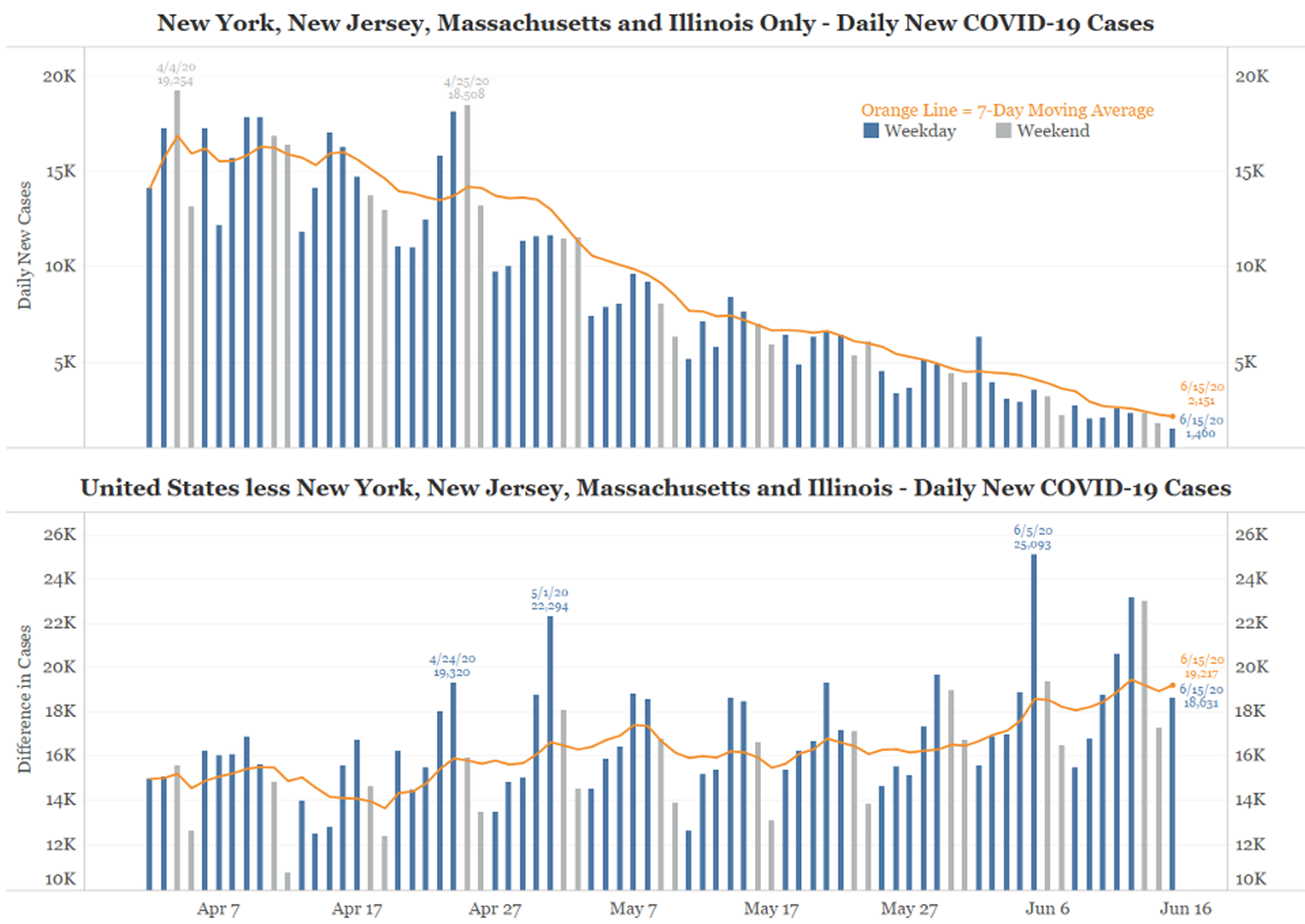

The United States can be divided into two areas, the large urban areas of New York City, Chicago, and Boston (top panel) and the rest of the country (bottom panel). Virus growth appears to be receding in urban areas, but not in the rest of the country.

So, what do we make of all this data? Well, we can see that it is migrating south for the winter however, the virus is still with us during our summer months. So, we may see a resurgence probably in the late summer, early fall, unless we can mitigate the spread of the virus successfully. As markets start to reflect heightened risks of the prolonged economic contraction, this could send a shock/increase volatility in the markets ahead. The markets may not be discounting this risk fully at this time, but that’s a lesser probability at this point. Why you might ask?

As we can clearly see, the virus is still out there and increasing in the number of cases in many areas of the world (even around parts of the US). But it doesn’t seem to be playing out in the market. The virus narrative seems to be waning. Our federal government continues to pump trillions of dollars into the financial system, which is the primary reason why markets continue to rise. One could argue that we’ve moved on from the virus story. I know that many of my friends and acquaintances have certainly tired of our leaderships mixed messages, sheltering in place, not being able to do this or that depending on what county you’re in. It seems extremely unlikely that we will have another shutdown at this point, but I didn’t want to just guess on this, so I took a look back in history (before SARS and MERS) and found some interesting data. Here are a few examples:

Woodstock (yes, the very concert in the 60s!). There was a pandemic right in the middle of Woodstock. This was a Hong Kong flu of 1968 to 1969, and Woodstock was argued to be a “super spreader event”. People tired of dealing with the “hassles” associated with the virus, and just did what they wanted.

In 1957 there was a pandemic that went through the United States from 1957 to 1959. That virus killed 150,000 people (which is today’s equivalent of 300,000 US citizens). I found it particularly interesting that none other than Dwight Eisenhower (our president at the time) refused to take the vaccine that had been developed. In this case our health care system got less than 25% of the public to actually take the vaccine. Americans again did what they wanted.

During the pandemic of 1918, there is actually a political movement called “No Masks”. People were so adamant about their liberties that they probably walked around in the middle of the pandemic (which was really bad), not wearing masks and formed a political party around that narrative.

Most of the surveys or polls that I’ve read say that less than half of the public says that if there is a vaccine developed, they’re going to take it…less than half. Keeping in mind that barely 25% of the public took a readily-available vaccine during the 1957 Asian Flu, I think that statistic may be valid. So, I think as far as it goes for the United States, we will not have another lockdown and I just can’t see things being that much different from the past. I really believe we’ve moved on from the virus narrative.

Keep in mind, I don’t think this is right. I think we should have strong, objective, conscientious and thoughtful leadership about what we should do societally to battle this virus. But if history is any guide at all, and it usually is a darn good one, I think we will ultimately resort to wearing masks and washing our hands, and that will be it regardless of what happens with infection rates.

A client recently sent us a very well-informed and fascinating article (thank you Melissa!). It’s well worth your time as it has a great deal of good information and is a realistic outlook about what to expect and what you can do. You can find it here: https://www.bluezones.com/2020/06/covid-19-straight-answers-from-top-epidemiologist-who-predicted-the-pandemic/

Our team at Aspire will continue to stay informed and provide the best guidance to our clients as the situation develops. In the meantime, don’t hesitate to reach out if you have any questions.

Be well!